Table of Contents

Have you heard the term digital transformation in banking before? Let me clear the concept first.

Imagine you’ve just landed a dream client. The proposal is signed, the handshake sealed, and excitement fills the air. But then, reality hits. You need to make a critical payment to secure your end of the deal. But there you are, stuck in a seemingly endless line at the bank, precious minutes ticking by. By the time you reach the teller, your client might be calling, wondering where their money is.

Here comes the revolution of digital transformation in banking. It is a new way to manage your finances with the agility and efficiency needed to thrive in today’s fast-paced business environment.

This blog post will delve into the world of digital banking transformation and explore how it can unlock a new era of financial control and empowerment for your business.

We’ll uncover the forces driving this transformation, unveil its transformative impact on businesses like yours, and equip you with the knowledge to embark on your own digital banking journey.

DON’T GET LEFT BEHIND!

Contents

- 1 DON’T GET LEFT BEHIND!

- 2 Digital Transformation in Banking Top Stats

- 3 Demystifying Digital Transformation in Banking

- 4 Unlocking Enhanced Efficiency and Agility

- 5 Boosting Cash Flow Management

- 6 Fortifying Security and Peace of Mind

- 7 Empowering Improved Decision-Making

- 8 Charting Your Digital Transformation Journey

- 9 Challenges in Digital Transformation in Banking

- 10 Future of Banking: A Glimpse into the Digital Horizon

- 11 Embrace the Digital Revolution with AppVerticals

- 12 Wrapping Up

- 13 FAQs

- 13.1 1. What is digital transformation in banking?

- 13.2 2. Why are banks undergoing digital transformation?

- 13.3 3. How does digital transformation in banking benefit banks?

- 13.4 4. How does digital transformation in banking benefit customers?

- 13.5 5. What are some examples of digital transformation in banking?

- 13.6 6. What are the challenges of digital transformation in banking?

Appverticals Crafts Cutting-Edge Fintech Solutions That Propel Banks Into The Digital Age. Boost Efficiency, Enhance Security, And Empower Your Customers.

Schedule a free consultation!

Digital Transformation in Banking Top Stats

-

BEST Webhosting

Explore a comprehensive array of web hosting services designed to cater to various needs. Whether you’re an individual looking for reliable personal hosting or a business requiring high-performance solutions, BEST Webhosting offers tailored options to ensure optimal website performance, robust security, and 24/7 support.

-

Unveiling the Pillars of Web Hosting

Web hosting is the backbone of a digital presence, providing the infrastructure necessary to publish and maintain websites online. This article delves deep into the essentials of web hosting, guiding individuals and businesses to make informed decisions. Learn about hosting types, server performance, and scalability options to choose the perfect fit for your online goals.

-

Digital Experience and Coding a New Website

Building a website today involves more than creating an online presence; it’s about delivering an exceptional digital experience. This piece explores modern website design principles, user experience strategies, and advanced coding techniques. It highlights how a well-crafted website can effectively convey your brand message, captivate audiences, and drive business success.

-

How to Buy a .com.au Domain: A Buyer’s Guide to .com.au Domains

This guide is a must-read for startups and established businesses aiming to enhance their Australian online presence. Learn the steps to secure a .com.au domain that aligns perfectly with your brand identity. The article provides insights into domain registration requirements, tips for choosing a memorable domain name, and the benefits of a local domain for SEO.

- Incredible Ideas deserve Incredible DomainsWith Rapid Registration, your domain is registered almost instantly, meaning you don’t have to wait to get your business or name online!

-

Edge of Technology, Digital Transformation, and Cloud Computing

Staying competitive in today’s fast-paced digital landscape requires leveraging cutting-edge technologies. This article explores the vital roles of Digital Transformation (DT) and Cloud Computing in modern business strategies. Understand how these technologies drive efficiency, foster innovation, and enable organisations to scale operations seamlessly.

-

The Best WordPress Plugins for Email Marketing to Grow and Engage Your Subscriber List

Email marketing remains a powerful tool for audience engagement and lead conversion. Discover top WordPress plugins like Mailchimp, Constant Contact, OptinMonster, and Thrive Leads. This article provides detailed guidance on creating effective opt-in forms, segmenting email lists, automating campaigns, and tracking metrics for successful email marketing strategies.

-

The Best WordPress Caching Plugins to Optimize Site Speed and Performance

Website speed and performance are crucial for user experience and SEO rankings. This detailed review covers the most effective WordPress caching plugins, including W3 Total Cache, WP Super Cache, WP Rocket, WP Fastest Cache, and LiteSpeed Cache. Learn how these plugins enhance site performance by minimising load times and optimising server resources.

- By 2024, mobile banking users are expected to reach 3.6 billion worldwide, up from 2.4 billion in 2020, representing a 50% rise.

- The Global Digital Transformation market is expected to reach $1009.8 billion by 2025, with a CAGR of 16.5%.

- Digital transformation is expected to increase the global economy by $100 trillion by 2025. Platform-based interactions will account for two-thirds of this value.

- The McKinsey analysis reveals a 26% increase in profitability for organizations embracing digital transformation, highlighting its relevance.

- The AR/VR technology market is estimated to expand by 10.77% from 2024-2028, reaching $58.1 billion in 2028.

- Strategic digital transformation initiatives have the potential to reduce operational expenses by 20-30%.

- By 2025, AI and machine learning technologies will automate 25% of the insurance sector.

- 75% of banks and credit unions have launched a digital transformation program, with another 15% planning to develop a digital transformation strategy.

Demystifying Digital Transformation in Banking

Digital transformation in banking isn’t just a fancy buzzword. 71% of businesses are actively considering or implementing bank digital transformation solutions. But what exactly does it mean, and how will it impact your business?

Digital transformation in banking is all about ditching outdated methods and embracing innovative technologies to revolutionize the way you manage your finances. Think of it as a complete makeover for your banking experience.

Instead of paper checks, imagine instant online payments. Forget manual reconciliations – picture automated systems handling the heavy lifting. These are just a few examples of how digital transformation in banking is shaking things up.

Key Areas of Digital Transformation in Banking

| Area of Transformation | Description | Example |

|---|---|---|

| Mobile Banking | Providing a user-friendly mobile app for account management, transactions, and financial services. | Customers can deposit checks, transfer funds, and pay bills directly from their smartphones. |

| Online Banking | Offering a secure online platform for account management, transactions, and financial services accessible through a web browser. | Customers can view account statements, manage investments, and apply for loans online. |

| Artificial Intelligence (AI) and Chatbots | Utilizing AI-powered chatbots to answer customer queries, provide personalized recommendations, and automate simple tasks. | Chatbots can assist customers 24/7 with basic questions about account balances, transactions, and banking services. |

| Big Data and Analytics | Leveraging customer data to personalize banking experiences, identify fraud risks, and optimize marketing strategies. | Banks can recommend financial products based on customer spending habits and predict potential financial needs. |

| Open Banking | Enabling secure sharing of customer data with third-party financial institutions to facilitate innovative financial services. | Customers can connect their bank accounts to budgeting apps or investment platforms for a more holistic financial experience. |

| Blockchain Technology | Implementing blockchain technology to enhance security and transparency in financial transactions. | Blockchain can streamline cross-border payments and improve traceability of transactions. |

| Cloud Computing | Utilizing cloud-based technologies to improve scalability, agility, and accessibility of banking services. | Banks can scale their IT infrastructure up or down based on customer demand and offer services anytime, anywhere. |

Now, let’s delve deeper into the driving forces behind this exciting shift.

Technological Advancements: A Game Changer

The digital revolution isn’t just changing the way we shop or connect with friends – it’s transforming the world of finance too. Cutting-edge technologies like artificial intelligence (AI), blockchain, and big data are playing a pivotal role in the digital transformation of banks.

Imagine having a virtual assistant (powered by AI) that detects and prevents fraudulent transactions on your business account. Or picture a system that automatically reconciles your bank statements, saving you countless hours of tedious work. This is the power of AI in action.

Blockchain technology, known for its secure transactions in the cryptocurrency world, is also making waves in digital transformation banking. It offers a tamper-proof way to record and track financial data, enhancing security and streamlining processes for businesses.

Big Data is the hero of financial insights. By analyzing vast amounts of data related to business finances, banks can provide you with personalized insights and recommendations. This empowers you to make informed decisions about your cash flow, investments, and overall financial health.

These are just a few examples of how emerging technologies are driving innovation in digital transformation banking. The possibilities are truly endless, and the benefits for businesses are undeniable.

Digital transformation catalyst in banking

| Catalyst | Description | Impact on Digital Transformation in Banking |

|---|---|---|

| Customer Demand | Shifting customer expectations towards convenient, personalized, and digital banking experiences. | Banks are prioritizing mobile banking, online account management, and user-friendly interfaces to meet these demands. |

| Technological Advancements | Emergence of new technologies like artificial intelligence (AI), big data, cloud computing, and blockchain. | These technologies enable automation, data-driven decision making, improved security, and innovative financial services. |

| Regulatory Landscape | Evolving regulations around open banking and data privacy, encouraging competition and innovation. | Banks are exploring ways to securely share customer data with third-party providers and comply with data protection regulations. |

| Competition | Increased competition from fintech startups and neobanks offering innovative digital banking solutions. | Traditional banks are pressured to adapt and improve their digital offerings to stay competitive. |

| Economic Pressures | Need to reduce costs and improve operational efficiency in a challenging economic environment. | Digital transformation can streamline processes, automate tasks, and optimize resource allocation. |

| Cybersecurity Threats | Growing cyber threats necessitate robust security measures to protect customer data and financial systems. | Banks are investing in advanced security technologies and data encryption to mitigate cyber risks. |

The Transformative Impact on Businesses

You’re racing against the clock to close a crucial business deal, but you’re stuck in a long line at the bank waiting to make a simple wire transfer. Frustrating, right? This scenario, all too familiar for many businesses, highlights the limitations of traditional banking methods. But fear not! The winds of change are blowing, and digital transformation in banking is here to revolutionize the way you manage your finances.

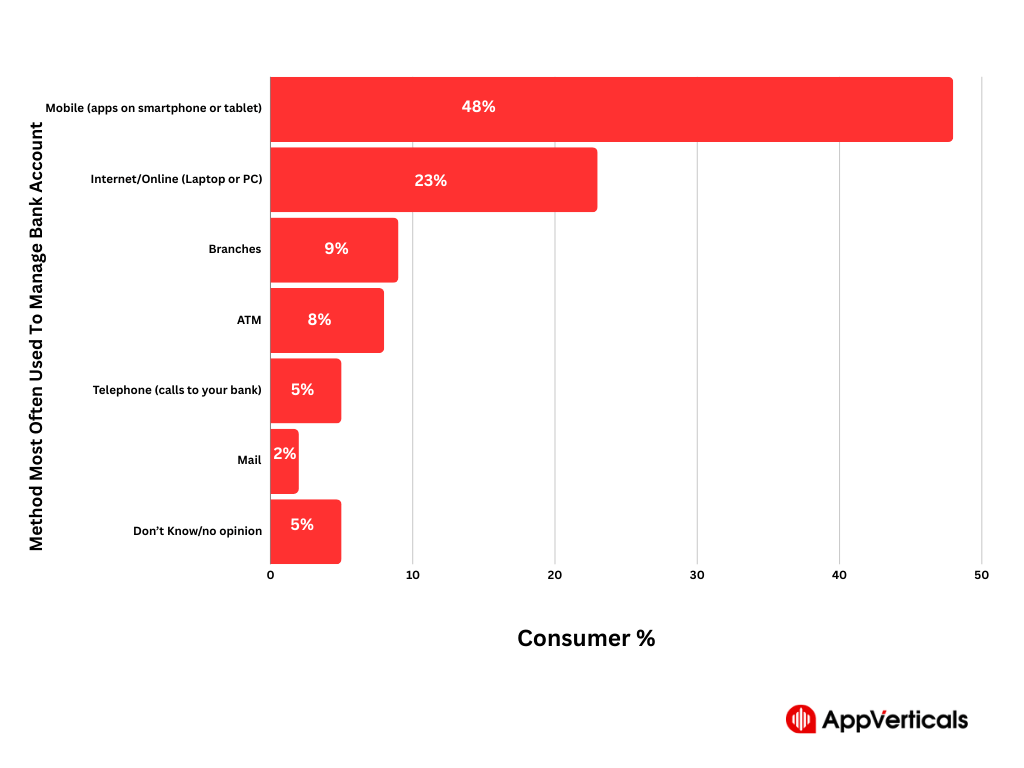

In a survey, a question (which method you often use to manage your bank account) is asked by U.S respondents. The following responses are achieved:

Unlocking Enhanced Efficiency and Agility

Every minute spent juggling paperwork and waiting for manual transactions to process is a minute taken away from focusing on core business activities—digital banking solutions step in as your time-saving heroes. Imagine processing invoices, paying bills, and transferring funds instantly, all from the convenience of your mobile phone or laptop. No more trips to the bank, no more waiting in lines – just a few clicks and your financial tasks are done.

But the magic doesn’t stop there. A recent study by found that Digital transformation improves operational efficiencies (40%), accelerates time to market (36%), and increases capacity to fulfill consumer demands (35%). That’s a significant chunk of time you can now dedicate to strategic planning, client acquisition, or simply enjoying a well-deserved coffee break!

Automation is another game-changer in the digital transformation landscape. Repetitive tasks like data entry and reconciliation can be automated, freeing up valuable human resources for more strategic endeavors. Your employees can now focus on building relationships with clients, developing new business opportunities, and driving growth while digital tools take care of the tedious back-office chores.

How is digital transformation in banking streamlining workflow automation?

| Traditional Workflow | Digital Transformation Automation | Benefits |

|---|---|---|

| Loan Applications | Online application portals, AI-powered document verification, automated credit scoring. | Faster processing times, reduced manual errors, improved customer experience. |

| Account Management | Online account opening, automated statements and notifications, self-service options for transfers and payments. | 24/7 access, increased efficiency, reduced reliance on manual tasks. |

| Customer Service | Chatbots for basic inquiries, automated fraud detection and resolution, AI-powered recommendations. | Improved first-contact resolution rates, reduced wait times, personalized service elements. |

| Compliance | Automated regulatory reporting, real-time transaction monitoring, machine learning for fraud detection. | Reduced risk of non-compliance, faster response to suspicious activity, streamlined reporting processes. |

| Back-Office Operations | Robotic Process Automation (RPA) for data entry and validation, automated reconciliation processes. | Increased processing speed, reduced manual errors, lower operational costs. |

| Risk Management | Big data analytics for customer behavior analysis, predictive modeling for fraud detection, automated risk scoring. | Proactive risk mitigation, improved decision-making, reduced potential losses |

Boosting Cash Flow Management

Ever feel like you’re constantly chasing after your cash flow? Wouldn’t it be amazing to have a clear, real-time picture of your finances at your fingertips? With digital banking platforms, you can achieve exactly that. Gone are the days of waiting for monthly bank statements or struggling with outdated spreadsheets.

Real-time access to account details allows you to monitor your cash flow in real time, track incoming and outgoing payments, and identify any potential discrepancies instantly. This level of transparency empowers you to make informed financial decisions, optimize your spending, and avoid cash flow shortfalls.

| Beneficiary | Digital Transformation Tools | Benefits for Cash Flow Management |

|---|---|---|

| Businesses | * Real-time Transaction Monitoring

* Automated Reconciliation * Cash Flow Forecasting Tools |

* Improved visibility and control over cash flow.

* Faster identification of potential cash flow shortages. * Data-driven decision making for optimized financial planning. |

| Individuals | * Personal Financial Management (PFM) Apps

* Automated Budgeting Tools * Bill Pay and Auto-Payments |

* Gain deeper understanding of spending habits and identify areas for savings.

* Create and stick to a budget for better financial control. * Ensure timely bill payments and avoid unnecessary late fees. |

Furthermore, digital banking solutions often come with features like automated receivables and payables. This means faster collection of payments from your clients and automated processing of your bills, eliminating the risk of late fees and ensuring a smooth cash flow cycle. Imagine receiving client payments instantly instead of waiting weeks for checks to clear – that’s the power of digital transformation in banking working for you!

Fortifying Security and Peace of Mind

In today’s digital age, data security is paramount. You wouldn’t want your business’s financial information to fall into the wrong hands, right? Digital banking understands this concern and employs robust security measures to protect your financial data.

Multi-factor authentication, where additional verification steps are required beyond just your password, adds an extra layer of security. Fraud detection algorithms constantly monitor transactions for suspicious activity, protecting you from potential cyber threats. Digital transformation in banking prioritizes security, giving you peace of mind to focus on running your business with confidence.

Empowering Improved Decision-Making

Ever wished you had a crystal ball to predict future financial trends for your business? While we can’t offer psychic powers (yet!), digital banking provides the next best thing: data-driven insights.

Financial data analytics, a key component of digital transformation in banking, helps you transform your raw financial data into actionable insights. Imagine gaining a clear picture of your spending patterns, cash flow trends, and overall financial health. These insights empower you to make informed financial decisions, optimize your business operations, and ultimately maximize profitability.

Think about it – you can identify areas where you can cut costs, prioritize investments in high-growth areas, and adjust your financial strategy based on real-time data. Digital transformation in banking equips you with the knowledge and tools to make smarter financial decisions that drive your business forward.

By embracing digital transformation in banking, you’re not just upgrading your financial tools – you’re unlocking a world of possibilities for your business to operate with greater efficiency, agility, and control. In the next section, we’ll delve deeper into how you can chart your digital transformation journey and leverage the power of bank digital transformation to unlock your business’s full potential.

Charting Your Digital Transformation Journey

Imagine this: you’re cruising through the grocery store, scanning your purchases with your phone at checkout. It’s fast, efficient, and feels futuristic, right? Well, that same level of technological innovation is now sweeping through the world of banking, and it’s time for your business to get on board!

This section is your roadmap to navigating the exciting world of digital transformation in banking. By following these steps, you’ll be well-equipped to craft a customized strategy that unlocks the power of digital tools and propels your business toward greater efficiency, agility, and financial control.

Step 1: Self-Assessment and Readiness Evaluation

Before diving headfirst into the digital realm, it’s crucial to assess your current banking landscape. Here’s where a little self-reflection comes in. Grab a pen and paper (or your favorite note-taking app) and answer questions like:

- Do we have secure online access to our accounts? Remember, secure online access is the foundation of digital banking.

- Are we still relying on paper checks for payments and invoices? Paper checks are slow and prone to errors. Digital alternatives can save you time and streamline your finances.

- How much time do we spend on manual tasks like data entry and reconciliation? Digital tools can automate these tasks, freeing up your valuable staff for more strategic endeavors.

By honestly evaluating your current state, you’ll gain a clear understanding of your strengths and weaknesses. This self-assessment will be your compass as you navigate the exciting world of digital transformation banking.

Step 2: Develop a Digital Transformation Strategy

Now that you have a clearer picture of your banking needs, it’s time to craft a customized digital transformation strategy. Here’s a step-by-step approach to get you started:

- Set Clear Goals: What do you hope to achieve through digital transformation? Is it faster payment processing, improved cash flow management, or enhanced security? Having clear goals will guide your decision-making throughout the process.

- Identify Your Budget: Digital transformation in banking doesn’t have to break the bank. There are solutions available to suit all budgets, from basic online banking platforms to comprehensive financial management systems.

- Seek Guidance (Optional): While you can navigate this journey on your own, consider seeking advice from financial consultants or technology experts specializing in banking digital transformation. Their expertise can help you avoid pitfalls and make informed decisions.

Step 3: Selecting the Right Digital Banking Solutions

Think of digital banking solutions as your new business allies. The key is to choose the right tools for the job. Here’s what to consider:

- Business Size: A small business has different needs than a large corporation. Choose solutions that cater to your specific size and complexity.

- Features and Functionality: Do you need basic online banking features or a comprehensive financial management system with advanced analytics? Match your needs to the functionalities offered by different solutions.

- User-Friendliness: Your chosen solutions should be intuitive and easy for your staff to use. A clear interface can lead to satisfaction and prompt adoption.

There’s a whole world of digital banking solutions available, from online banking platforms and mobile banking apps to integrated financial management systems. Don’t get overwhelmed—the next step will guide you through exploring the different options.

Step 4: Exploring the Digital Banking Solutions Landscape

Now that you understand your needs and have a strategy in place let’s delve into the exciting world of digital banking solutions! Here’s a sneak peek at some of the powerful tools available:

- Online Banking Platforms: These web-based platforms offer a central hub for managing your finances. You can view account balances, transfer funds, pay bills electronically, and even download transaction history – all from the convenience of your computer.

- Mobile Banking Apps: Take your banking on the go with mobile banking apps! These user-friendly apps allow you to check account balances, deposit checks remotely using your phone’s camera, and even approve payments – all with just a few taps. Imagine the convenience of managing your finances while waiting in line for coffee!

- Integrated Financial Management Systems (IFMS): IFMS can be a game-changer for businesses with complex financial needs. These comprehensive systems integrate various financial functions like accounts payable and receivable, budgeting, and forecasting into a single platform. This level of integration offers real-time insights and streamlined processes, allowing you to manage your finances with greater precision.

Remember, this is just a glimpse of the digital banking solutions available. Many providers offer customizable packages that can be tailored to your specific needs. Think of it like building your financial toolkit – you can choose the tools that best suit your business goals and operations.

Step 5: Implementation and Change Management

So, you’ve chosen your digital champions (your new digital banking solutions)! Now comes the exciting part – implementation. Here are some key considerations:

- Effective Communication: Clearly communicate the upcoming changes to your staff. Explain the benefits of digital transformation and provide comprehensive training to ensure smooth adoption of the new tools.

- User Training: Proper user training is crucial. Make sure your staff feels comfortable and confident using the new digital banking solutions. Offer ongoing support and answer any questions that may arise.

- Managing Resistance: Change can be challenging, and some employees might resist the transition to digital tools. Address their concerns openly and provide reassurance. Highlight the benefits of digital transformation for both the business and individual employees.

By following these steps and fostering a culture of open communication, you can ensure a smooth and successful implementation of your digital banking solutions.

The Takeaway!

Digital transformation in banking is no longer a futuristic vision – it’s the present! By taking a proactive approach, crafting a customized strategy, and selecting the right tools, your business can unlock a world of possibilities. Embrace the digital revolution and watch your business soar to new heights of efficiency, agility, and financial control!

Challenges in Digital Transformation in Banking

| Category | Challenge Description | Potential Impact | Mitigation Strategies |

|---|---|---|---|

| Legacy Systems | Outdated infrastructure hinders innovation, integration, and scalability. Migrating to new systems can be disruptive and expensive. | * Slow adoption of new technologies.

* Difficulty in meeting customer demands for seamless digital experiences. * Increased operational costs. |

* Upgrade systems in stages to minimize disruption.

* Leverage cloud computing for scalability and flexibility. * Enable communication between new and legacy systems. |

| Cybersecurity Threats | Evolving cyber threats necessitate constant vigilance and investment in security measures. Data breaches can erode customer trust and lead to financial losses. | * Increased risk of data breaches and cyberattacks.

* Regulatory fines for non-compliance with data security standards. * Reputational damage. |

* Implement firewalls, intrusion detection systems, and data encryption.

* Identify vulnerabilities and address them promptly. * Empower employees to recognize and mitigate cyber threats. |

| Cultural Shift | Transitioning to a digital-first culture requires overcoming resistance to change and fostering a culture of innovation and collaboration. | * Slow adaptation to new technologies and processes.

* Silos between departments can hinder progress. * Difficulty attracting and retaining talent with digital skills. |

*Communicate the benefits of digital transformation and provide training for employees.

* Executive leaders must champion digital transformation initiatives. * Encourage experimentation and reward success stories. |

| Data Management | Balancing the need for data-driven insights with data privacy regulations like GDPR and CCPA is crucial. Managing vast amounts of customer data efficiently requires robust infrastructure. | * Difficulty complying with data privacy regulations.

* Customer concerns about data security and privacy. * Inefficient data management leading to wasted resources. |

* Establish clear policies and procedures for data collection, storage, and access.

* Protect sensitive customer information while enabling data analysis. * Leverage technology to improve data management and derive insights efficiently. |

| Integration Challenges | Seamlessly integrating new technologies with existing systems can be complex and time-consuming. Incompatible data formats and APIs can hinder successful integration. | * Inefficient data exchange between different systems.

* Siloed operations hindering a holistic customer experience. * Increased development and maintenance costs. |

* Develop or adopt industry-standard APIs to facilitate smooth integration.

* Break down large applications into smaller, modular components for easier integration. * Ensure seamless data flow between systems. |

| Regulatory Landscape | Evolving regulations around open banking, data privacy, and cybersecurity require continuous adaptation and compliance efforts. | * Failure to comply with regulations can result in hefty fines.

* Difficulty keeping up with the pace of regulatory change. * Limited innovation opportunities due to regulatory constraints. |

* Stay informed about regulatory changes and ensure compliance.

*Seek guidance from professionals to navigate the regulatory landscape. * Engage with regulators to foster a supportive environment for digital transformation. |

| Financial Inclusion | Ensuring everyone has access to digital banking solutions requires addressing the digital divide and financial literacy gaps. | * Exclusion of certain demographics from accessing digital banking services.

* Increased inequality and limited financial opportunities for some individuals. * Reputational risk for failing to serve all communities. |

* Design intuitive digital platforms that are accessible to users with varying levels of digital literacy.

*Offer financial literacy programs and outreach initiatives to bridge the digital divide. * Maintain a network of physical branches to complement digital services. |

| Talent Acquisition and Retention | Attracting and retaining skilled personnel with digital expertise is crucial for successful transformation. | * Difficulty finding professionals with the necessary skills and experience.

* High competition for top talent in the digital space. * Employee churn hindering progress and knowledge transfer. |

* Upskill existing employees in digital technologies.

* Encourage continuous learning and professional development. * Showcase the bank’s commitment to innovation and a digital-first approach. |

Future of Banking: A Glimpse into the Digital Horizon

The digital transformation journey in banking is far from over. As technology continues to evolve, we can expect even more exciting trends to emerge in the coming years. Here’s a sneak peek at what the future holds:

- Open Banking APIs: Imagine a world where your financial data can seamlessly flow between different institutions, giving you greater control and flexibility. Open Banking APIs are making this a reality. These APIs allow authorized third-party applications to securely access your financial data with your permission, opening doors for innovative financial products and services tailored to your specific needs.

- Artificial Intelligence (AI) for Personalized Banking: Get ready for a banking experience that feels like it knows you better than you know yourself! AI is rapidly transforming the way banks interact with their customers. AI-powered chatbots can provide 24/7 customer support, analyze spending habits to recommend personalized financial products, and even identify potential fraud in real time.

These are just a few examples of the exciting possibilities on the horizon for digital transformation in banking. The future of banking is all about personalization, convenience, and empowered customers.

Embrace the Digital Revolution with AppVerticals

Businesses that embrace digital transformation in banking and fintech services are poised to thrive. At AppVerticals, we’re passionate about helping companies navigate this exciting digital landscape. We offer a comprehensive suite of digital banking solutions designed to streamline your financial operations, boost efficiency, and empower you to make smarter financial decisions.

Stay caught up! Contact AppVerticals today to take the first step towards a brighter fintech future. We’ll help you chart your course in digital transformation banking and unlock your business’s full potential.

Wrapping Up

Digital transformation in banking is no longer a question of “if” but “when.” It presents a remarkable opportunity for businesses to streamline operations, enhance customer experiences, and unlock new revenue streams. By embracing digital transformation in banking, businesses can gain a competitive edge in the rapidly evolving financial landscape.

However, navigating this digital transformation journey requires a strategic approach and the right tools. Your fintech app development company, AppVerticals, is here to help.

We specialize in developing cutting-edge financial technology solutions that empower businesses to capitalize on the full potential of digital transformation in banking.

Don’t miss out on the future of finance – embark on your digital transformation journey today!

FAQs

1. What is digital transformation in banking?

Digital transformation in banking refers to the integration of advanced technologies and innovative strategies to revolutionize the way banks operate and deliver financial services. It involves modernizing traditional banking systems, processes, and business models to provide a seamless, convenient, and secure user experience through various digital channels. This transformation leverages technologies like artificial intelligence (AI), big data analytics, cloud computing, and mobile technology to enhance efficiency, personalize customer interactions, and offer a wider range of digital banking solutions.

2. Why are banks undergoing digital transformation?

Several factors are driving digital transformation in banking. Here are some key reasons:

- Shifting customer demands.

- Technological advancements.

- Increased competition.

- Economic pressures.

3. How does digital transformation in banking benefit banks?

Banks can reap numerous benefits from digital transformation, including:

- Reduced Operating Costs: Automation and streamlined processes lead to operational cost savings.

- Increased Customer Engagement: Enhanced digital experiences improve customer satisfaction and loyalty.

- Improved Efficiency and Automation: Automation of repetitive tasks frees up staff for higher-value activities.

- Data-Driven Decision Making: Big data analytics provide valuable insights for better financial planning and risk management.

- Increased Revenue Opportunities: Digital transformation enables banks to develop new, innovative financial products and services.

4. How does digital transformation in banking benefit customers?

For customers, digital transformation in banking translates into:

- Improved convenience and accessibility

- Personalized banking experiences

- Faster and more efficient transactions

- Enhanced security and fraud protection

- A wider range of financial products and services

- Greater control over finances

5. What are some examples of digital transformation in banking?

Here are a few prominent examples of digital transformation in banking:

- Mobile Banking Apps: Provide real-time access to account balances, transaction history, mobile bill payments, and fund transfers.

- Online Loan Applications: Streamlined processes for applying for loans and receiving approvals electronically.

- AI-Powered Chatbots: Offer 24/7 customer support, answer basic queries, and resolve simple issues.

- Big Data Analytics: Leverage customer data to personalize financial recommendations and tailor marketing strategies.

- Open Banking: Allows secure sharing of customer data with third-party financial institutions for a more holistic financial experience.

6. What are the challenges of digital transformation in banking?

Despite its advantages, digital transformation brings certain challenges for banks:

- Legacy systems

- Cybersecurity threats

- Cultural shift

- Data management

- Integration challenges

- Regulatory landscape

- Financial inclusion

- Talent acquisition and retention